Ready to dive in and start calculating the P/E ratio of your favorite stocks? To calculate a stock’s P/E ratio, you’ll need to know the stock’s earnings per share (EPS) and its share price.

#Etf expense ratio how to

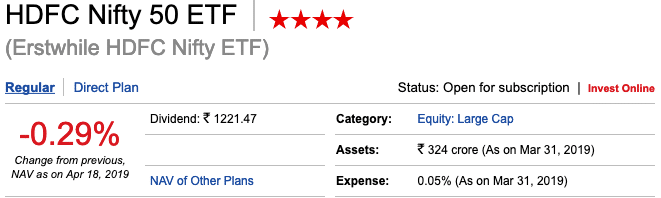

How to calculate P/E ratio using the P/E ratio formula Now that you have a feel for what a low or high P/E ratio can mean, let’s find out how you can calculate the P/E ratio of a stock. On the other hand, a higher P/E ratio can be seen as a worse deal, as you are spending more money for each dollar of company earnings. This is because you are spending less money for each dollar of a company’s earnings. When comparing a P/E ratio to the market average or competitors, a stock with a lower P/E is generally good. So what is a good price-to-earnings ratio? To help you learn more about what makes a P/E ratio good or bad, we’ve broken down what a low and high price-to-earnings ratio generally means. Because of this, it’s important to always compare P/E ratios with other companies within the same industry. For example, a P/E ratio of 10 could be normal for the utilities sector, even though it may be extremely low for a company in the tech sector. Anything below that would be considered a good price-to-earnings ratio, whereas anything above that would be a worse P/E ratio.īut it doesn’t stop there, as different industries can have different average P/E ratios. Typically, the average P/E ratio is around 20 to 25. Generally speaking, investors prefer a lower P/E ratio, but to fully understand if a P/E ratio is good or bad, you’ll need to use it in a comparative sense. The difference between a good and bad P/E ratio is not as cut and dry as it may seem. How to tell if a P/E ratio is good or bad So what is a good P/E ratio for stocks, and how can you calculate a P/E ratio yourself? Follow this beginner’s guide to learn more about P/E ratios, what they can tell you about a stock, and some of the ratio’s shortcomings. The P/E ratio helps you answer a simple, fundamental question when trying to decide if you should buy a stock: Are you paying too much? Good news, though, as there’s nothing extracurricular about “P/E”-it’s one of the most widely used stock market terms and tools in the investment playbook.Ī P/E ratio, also known as a price-to-earnings ratio, is the ratio between a company’s stock price and its earnings per share (EPS). When looking at the P/E ratio alone, the lower it is, the better.įor new investors, “P/E” might as well mean “physical education.” Gold ETFs in comparison carry a higher expense ratio of between 0.45% to 0.51% but have also the potential to generate as in the current times good enough returns.What does a good P/E ratio mean? In simple terms, a good P/E ratio is lower than the average P/E ratio, which is between 20–25. Now here are some Nifty and Sensex based ETF that carry the lowest expense ratio: ETF So, as this reduces the investors' return, it makes sense to go by low-cost product which in ETF gamut is denoted by lower expense charges.īharat 22 ETF i.e not from the Nifty or Sensex backed category and is rather a government backed ETF carries the lowest expense ratio at 0.01%. 1 basis point is one hundredth of a percentage point. And this cost factors become even more important with time say for an ETF you pay 5 bps as the expense ratio then over 10 years period your cost will be 50 basis point.

0 kommentar(er)

0 kommentar(er)